The

pension for the

self-employed.

The simplest way to save.

Flexible payments

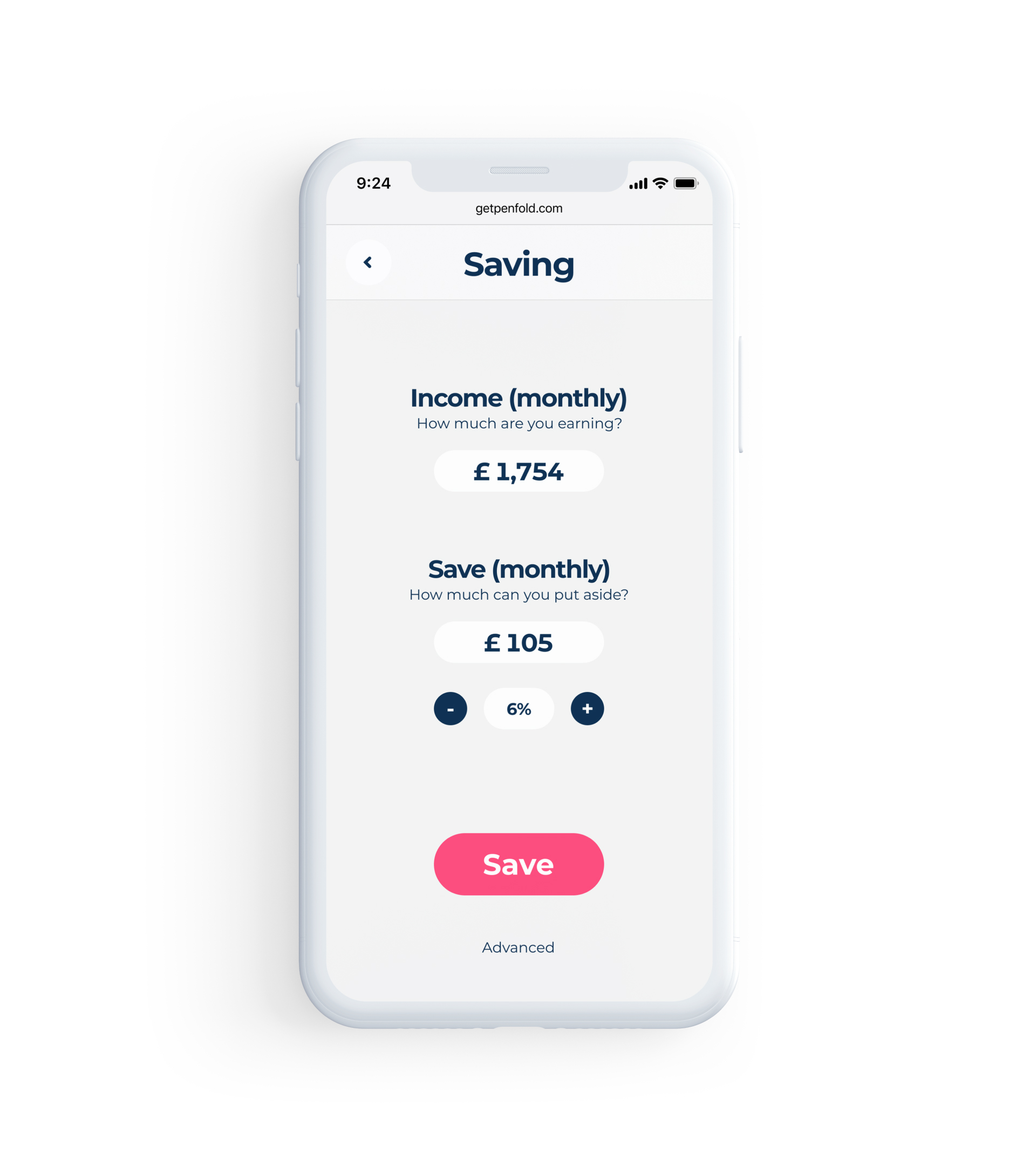

When you’re self-employed, your finances aren’t easy to forecast.

Penfold is designed to be as flexible as you. Once you start saving, you can top up, change, or pause your payments at any time — instantly and online.

Sign me up

I've often worked as a contractor without an employer pension.

I thought it would be a hassle, but Penfold made it super easy to set up online in a few minutes.

Alex Heaton,

Software Developer

Designed for simplicity

Set up your account in 5 minutes and start saving today.

It’s easy to decide how much to save using our pension calculator, and it can help you get a better picture of your future finances.

Sign me up

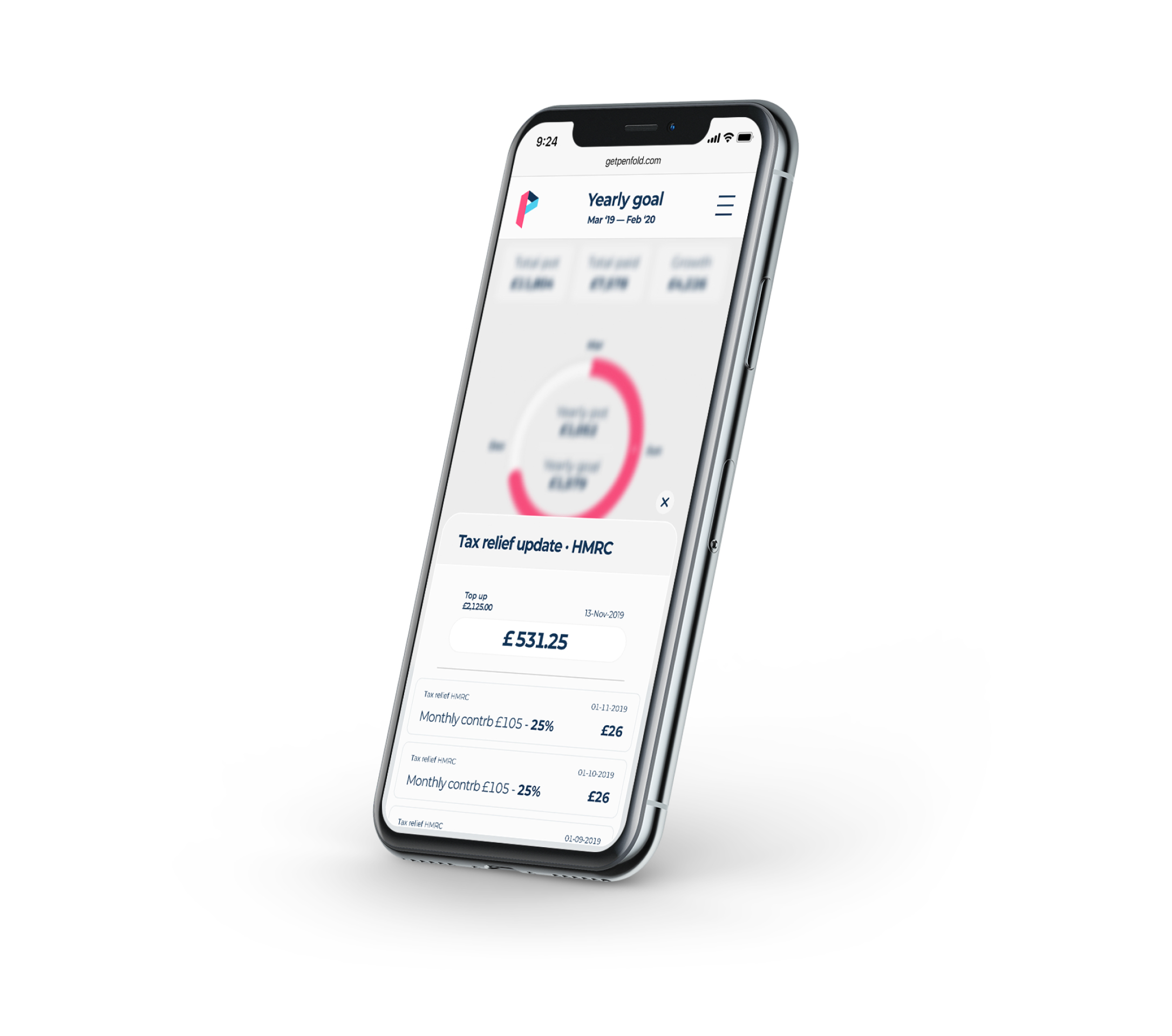

25% savings bonus

The government adds a 25% bonus to everything you save into a pension.

That’s guaranteed cashback on what you save and we organise it for you, adding it directly to your pension.

Sign me up

Easy setup

Setting up a pension can be a pain, so we’ve made it super simple.

Create an account in 3 easy steps and boom, you’re done. We’ll handle the admin from there, so you don’t have to.

Easy setup

Setting up a pension can be a pain, so we’ve made it super simple.

Create an account in 3 easy steps and boom, you’re done. We’ll handle the admin from there, so you don’t have to.

Choose how much to save

Pick a growth profile

Not even a step, just done.

Powered by

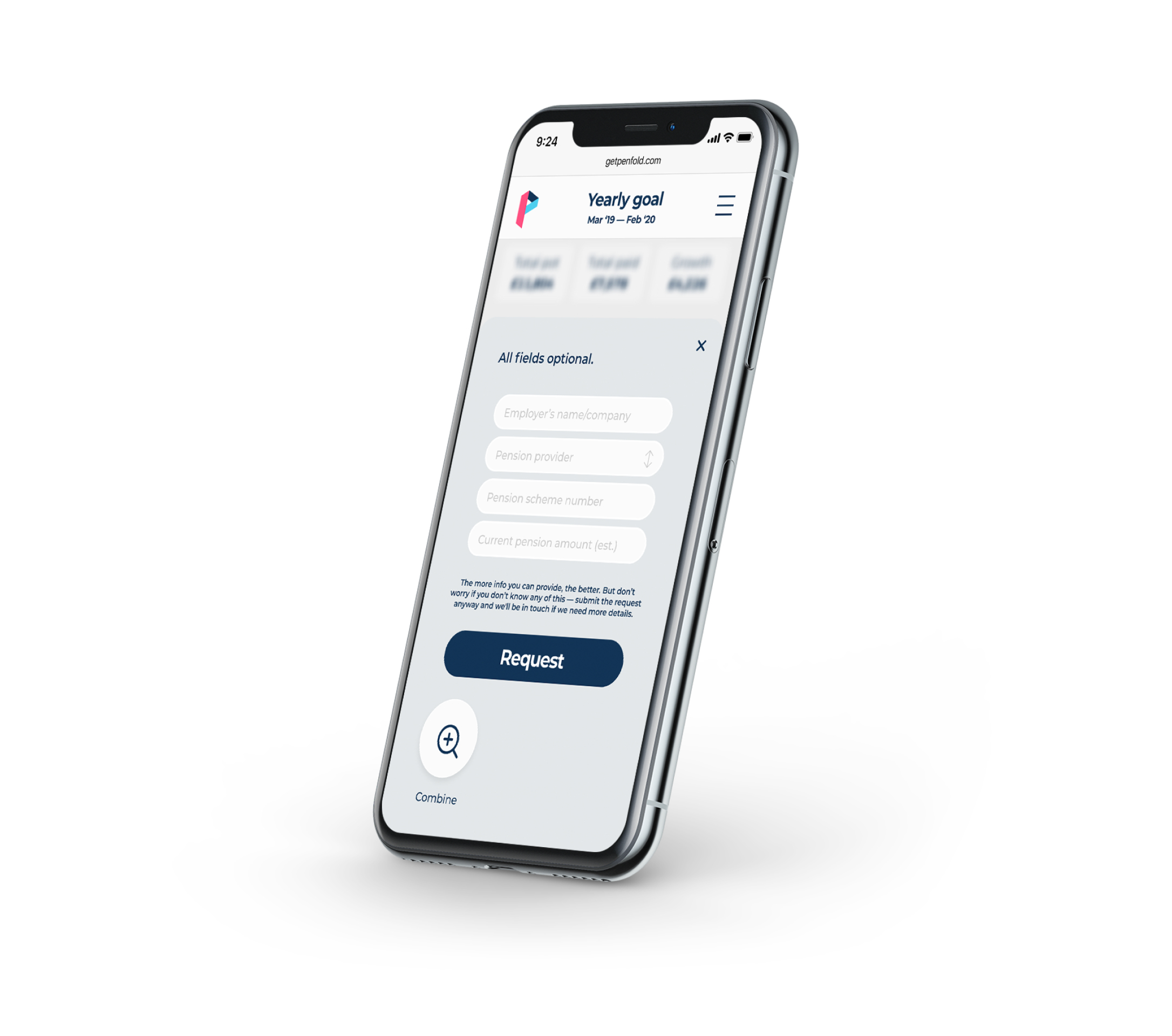

Find and combine

If you have other pension pots, we can track them down for you.

Consolidating your pension with Penfold is easy, free of charge, and our friendly customer service will manage it on your behalf.

Sign me up

Professionally managed

We are partnered with BlackRock, the largest asset manager in the world.

They handle your investments for you based on the growth profile you choose. Learn more about investing.

Sign me up

Protected

We take your pension’s safety and your trust very seriously.

Penfold is FCA regulated, and Penfold pensions are FSCS-protected.

Soon

Be notified about our new app.

Do you like cookies? 🍪 We use cookies to ensure you get the best experience on our website.